Junior Achievement of San Diego County (JA) recently opened the Mission Fed JA Finance Park, an innovative, interactive educational center, to teach a new generation of tech-savvy high school students how to plan for future careers and budget for financial success.

Although the program’s target demographic is teens, JA for Everyone also allows families and adult individuals to experience Finance Park. “We welcome adults and families who want to learn from the mistakes they’ve made or avoid them all together,” explains JA Finance campaign manager Martha Phillips.

The contemporary approach teaches all participants the financial impacts of real-life situations such as career choice, bad credit scores, student loans and credit card debt. The high-tech, paperless simulation is housed in a brand-new, state-of-the-art 6,300-square-foot facility in Mission Valley.

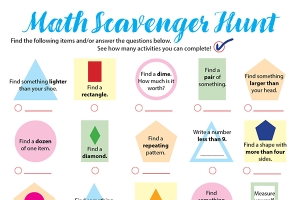

Because today’s kids rely on technology to navigate through every day experiences, it has been implemented into the program. At JA Finance Park, students use individual Samsung tablets and an impressive array of wall-mounted touch screens to explore a variety of authentic scenarios.

Before arriving, participants choose a job based on personal interest, such as a firefighter, nurse, marketing specialist or professor. Upon arrival, each participant is presented with a life situation that includes the chosen job’s actual salary, family demographics (married? kids?), outstanding debt and other relevant information. Next, students get to customize the appearance of their avatar and virtual families. Then, they set aside money for savings—long-term, emergency and retirement.

Finally, students explore Finance Park’s 14 shops and five kiosks, each representing a budget line item, to research various options and make purchasing decisions that will (hopefully) result in a balanced budget by the end of the day. They will attempt to buy a car and a home (although not all loan requests are approved!), shop for groceries, make investments and donate to charity.

Since the overall topic of finances is often stealthily avoided among families, the conversations that arise along the way are invaluable as participants discuss what they can or can’t afford. Some common questions that arise include: How does eating organic affect my grocery bills? Should I rent or purchase a house? How does a lower deductible affect my insurance rates? Should I buy the truck, Mustang or take the trolley? Why wasn’t my loan approved? How often can I afford to eat out? What forms of family entertainment are free? How much money should I donate to charity?

JA Finance Park is offered through local high schools, afterschool programs, work force partnerships, YMCA summer camps and Boy Scout outings. Alternatively, families and adult individuals can attend on a weekday night or a Saturday, choosing between a three- or four-hour experience. The cost is $24 for an individual and $40 for a family of four. Scholarships and reduced fees are available. Contact Cheryl Einsele at

The interactive approach goes far beyond a basic financial literacy class towards teaching participants of all ages important life lessons. So, whether you’re a teen considering a future career or an adult struggling to balance the family budget, envision your full potential and explore the financial impacts of your decisions. It is never too early—or too late—to step into JA Finance Park and plan for success.

Lisa Pawlak is an Encinitas resident and mother of two sons. She is a frequent contributor to San Diego Family Magazine and the Chicken Soup for the Soul series.

Published October 2015